Crypto Accounting

Prosperity Financial Accounting adheres to forward thinking, technology-based solutions with tried and tested processes that produce reliable financial information.

At Prosperity Financial Accounting, we are not afraid of filing cryptocurrency taxes. Many CPAs don’t want to go near cryptocurrency. We are not one of them. We’ve done lots of research on this and have even taught webinars with groups that wanted to understand cryptocurrency taxes better. We find that if we educate people, they will be better informed but, at the same time, might not want the headache of filing themselves because cryptocurrency is very complicated.

Cryptocurrency is not foreign to us. We recommend creating a ledger every month so clients can keep track of all the transactions that are taking place. Being organized is key to ensuring that what is being classified as a sale is being taxed. It’s not easy when multiple “wallets” are involved, and hundreds of transactions occur. If you get disorganized, you may not know where and what transaction was made or where it went. Transfers between your wallets aren’t taxable; however, if you don’t keep track of it, you may have to go ahead and pay taxes on them because you won’t want to take the risk of not claiming them and pay $100s if not $1,000s more in taxes.

With the advent and recent popularity and soaring prices of cryptocurrency, especially Bitcoin (BTC), there’s a need for accounting for cryptocurrency especially in regard to taxes.

IRS Treatment of Cryptocurrencies

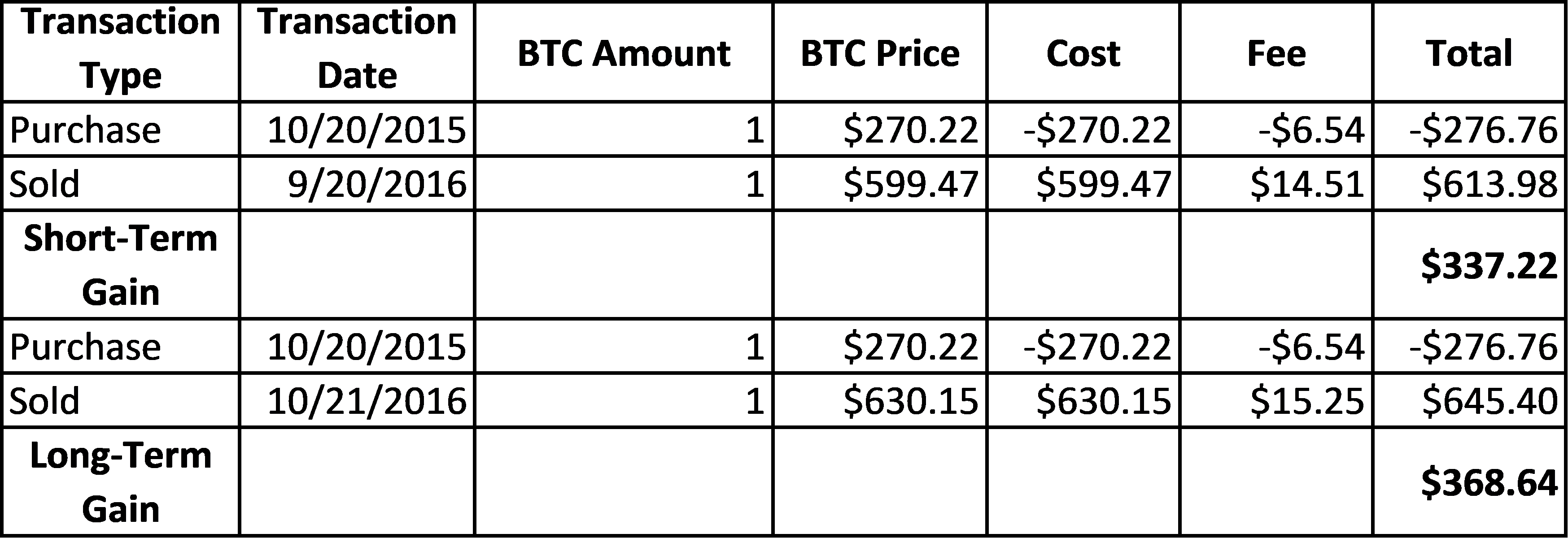

In March of 2014 the IRS released Notice 2014-21 that addressed some, not all, of the questions about how the IRS is going to treat cryptocurrency. The IRS will treat cryptocurrency as property, not currency. This means when you purchase or sell a cryptocurrency you need to record its cost basis in US Dollars (purchase price plus any fees) using its fair market value. When you sell BTC you need to calculate your short-term or long-term gain. For example, you purchased 2 BTC when it was $270.22 per coin on October 20, 2015, sold 1 BTC on September 20, 2016 for a short-term gain and sold 1 BTC on October 21, 2016 for a long-term gain. You would record the transactions as:

This needs to be done for all transactions, not just an exchange. If you use BTC to purchase anything, you would create a transaction, like above, for the amount of BTC you used. This can become a cumbersome task. If you prefer not to do this process through an Excel worksheet, you can use one of the software programs to track your BTC transactions, or pay your accountant to manage it. My firm, Dollars & Sense Bookkeeping, offers BTC accounting services using software to track all your transactions and your gains/losses.

Fair Market Value

You calculate the cost basis using the fair market value on the date you received the BTC. Not the time, the date (day). Since cryptocurrencies fluctuate by the second, this creates an interesting situation. Unless you have already converted the BTC into cash, you have choices in how you want to interpret the fair market value of that day. You could choose:

The average price on the day of receipt

The price the second you receive the BTC

The day’s high price

The day’s low price

Different people will choose different options for calculating the fair market value. Even you could choose different methods – use the day’s high when purchasing and the day’s low when selling. The IRS has not yet stated whether they will require you to use a consistent method for each decision point.

Short-Term vs Long-Term Gains/Losses

Property must be held for 1 year and 1 day before exchanging, selling (or in the cryptocurrency world, used to pay for goods or service), to be considered a long-term gain and taxes at capital gains tax rates. Anything less and your gain/loss is considered short-term and is taxed at ordinary income rates.

Reporting Options

The IRS has yet to state whether you will be required to use a specific inventory method for reporting. Your options include first-in-first-out (FIFO), last-in-first-out (LIFO), specific lot, and average cost. Whichever you choose, you must stick with that accounting method. For purposes of this paper, we will assume you are using FIFO. FIFO is a cost flow assumption that the first BTCs purchased are also the first BTCs sold. This method assists in meeting the requirements for gains to be considered long-term instead of short-term.

Title 26 U.S. Code §1031 – Exchange of property held for productive use or investment

Since the IRS is treating cryptocurrency as property, people are wondering if they can do a §1031 exchange. However, §1031 specifically states that exchanges won’t apply to property held primarily for sale. Unless you want to be the one testing this tax court, I suggest you recognize gains/losses when you exchange cryptocurrency for other property even other cryptocurrencies.

BTC Mining & Commissions

When you mine BTC or get commissions from a mining company, you have to report this as income as well as booking the fair market value of the BTC you’ve received as property, even if you reinvest the BTC into more mining operations. The U.S. Legislature is considering the Cryptocurrency Tax Fairness Act of 2017 which would make the minimum threshold for reporting this type of income at $600 for the year. Currently you need to report every bit of income, even if it’s less than $600 for the year.

Paying for Services/Paying Employees

If you pay your employees or contractors in BTC, you treat it just like regular wages. For employees, you’ll need to withhold taxes, for contractors, you need to 1099 them if you pay them more than $600 in a year and if you don’t receive a W-9, the payments are subject to backup tax withholding.

Previous Tax Year

If you haven’t been reporting your cryptocurrency dealings properly on your tax returns, you could face an audit from the IRS. They are actively going after BTC investors and have recently won a case against Coinbase to turn over the identification of any user trading more than $20,000. A court document read, “Coinbase itself admits that the Narrowed Summons requests information regarding 8.9 million Coinbase transactions and 14,355 Coinbase account holders. That only 800 to 900 taxpayers reported gains related to bitcoin in each of the relevant years and that more than 14,000 Coinbase users have either bought, sold, sent or received at least $20,000 worth of bitcoin in a given year suggests that many Coinbase users may not be reporting their bitcoin gains.” Start

reporting your income now and amend any prior year tax returns you didn’t properly report BTC on.

The IRS can only audit back 3 years; however, there are special circumstances that can extend that time period. If you have committed tax fraud, then there is NO TIME LIMIT. They can go back over every year of your adult life and audit your tax returns. “Tax fraud occurs when an individual or business entity willfully and intentionally falsifies information on a tax return in order to limit the amount of tax liability. Tax fraud essentially entails cheating on a tax return in an attempt to avoid paying the entire tax obligation” (Investopedia). Civil penalties for back taxes owed include a fine up to 75% of the owed taxes on top of paying the back taxes. Criminal penalties range from a $100,000 fine and 5 years in prison for individuals and $500,000 fine and 5 years in prison for business owners. If you have past cryptocurrency dealings not properly reported, you might want to talk to a tax attorney, not a CPA, accountant, bookkeeper, or Enrolled Agent. Only a tax attorney is provided attorney-client privilege. Your bookkeeper, CPA, accountant, or Enrolled Agent can be subpoenaed by the IRS and become a witness against you.

Disclaimer

This note is does not intend to represent tax law. Nor does it intend to substitute for your specific tax professional. Please consult your tax advisor for detailed analysis of your unique tax situation as everyone’s tax situation is different. Tax laws are going to continue to change and what I’ve stated here might not be correct in the future. Always consult your tax professional. Generally, investing in cryptocurrency is risky, proceed at your own risk.